Payments to Students Guide

Guidelines and Procedures

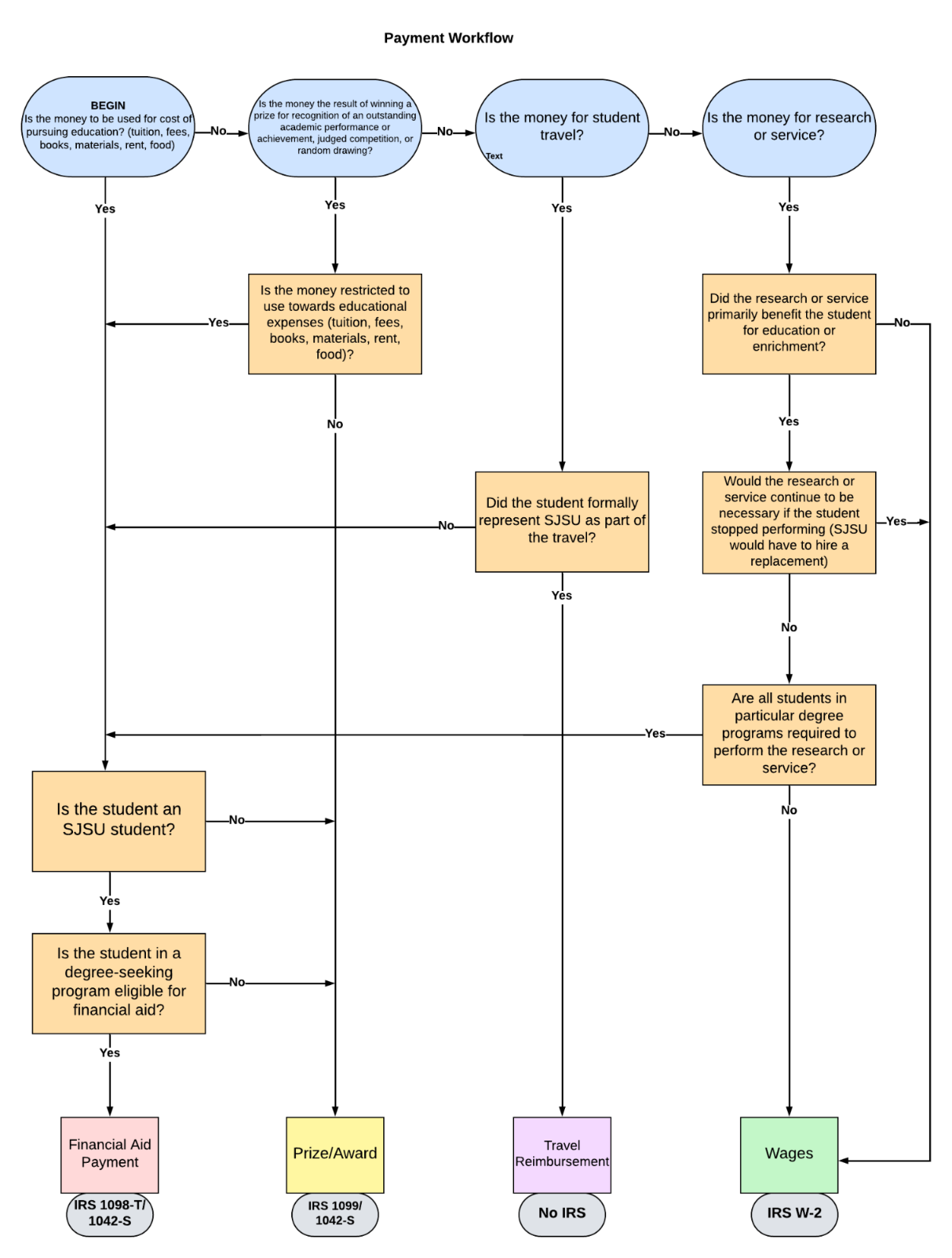

When paying monies to a student, it is critical to ensure the payment has been classified correctly in order to satisfy compliance requirements with Internal Revenue Service, federal financial aid regulations, CSU policies, and donor intent. While SJSU strives to comply with intent of donors when administering funds to students on their behalf, donor intent, no matter how specific or strongly worded, may not supersede the university’s obligation to meet federal and state financial aid rules, IRS regulations, Fair Labor Standards Act, or other CSU rules or guidelines.

At SJSU, there are four categories of payments to students:

Financial Aid

Payments that assist the student in their pursuit of education (tuition, fees, books, equipment required for a course, or room and board). These payments are made via the Financial Aid and Scholarship Office and the student information system (PeopleSoft), with the IRS reporting via 1098-T.

Prize/Award

Payments for winning a contest or an award where the funds for both do not have to be used towards educational expenses (tuition, fees, books, equipment required for a course, or room and board). These payments are paid via SJSU Payment Services with IRS reporting via Form 1099-MISC. These payments are considered non-educational direct payments.

Travel Reimbursements

Payments that reimburse students for travel whenever, via the travel, a student is formally representing SJSU (SJSU is the primary beneficiary of the student travel). There is no IRS reporting.

Wages

Wages represent compensation for services rendered where SJSU is the primary beneficiary. Payroll processes the payments, which are subject to IRS reporting via form W-2.

Financial Aid-Educationally Related Awards

The taxability of educationally-related awards is governed by Internal Revenue Code (IRC) Section 117. This type of award is defined as an amount paid or allowed to, or for the benefit of, a student to aid such an individual in pursuing his studies, including independent research that does not directly benefit the grantee. Individuals receiving educationally-related awards do not provide services to the grantor where the grantor benefits from the work or research done by the individual.

A requirement that a recipient furnish periodic reports to the grantor to keep the grantor informed about the individual's general progress does not constitute the performance of services.

Scholarships

A scholarship is generally paid to benefit a student at an educational institution to aid in pursuing studies. The student may be in either a graduate or an undergraduate program. Scholarships can be either qualified or nonqualified:

- A qualified scholarship pays for tuition and related expenses at a qualified educational institution, such as any CSU. Tuition includes amounts paid for enrollment and “related expenses,” including fees, books, supplies, and course equipment. A qualified scholarship is nontaxable to the recipient.

- A nonqualified scholarship pays for all other student expenses, such as room, board, and travel. It is generally taxable to the recipient.

It is a scholarship if travel costs are paid to support the student’s educational pursuits (i.e. if the payment directly benefits the student and not the university).

Grants

Grants are gifts of money to students who meet specific eligibility criteria that do not have to be earned or repaid. Grants may or may not be need-based.

Fellowships

A fellowship is an amount paid to benefit an individual to aid in pursuing study or research. Generally, fellowships are short-term opportunities lasting from a few months to several years, focusing on professional development. Fellowships are sponsored by a specific association or organization seeking to expand leadership in their field. Fellowships have traditionally been awarded to graduate and post-graduate students. Fellowships provide a living allowance that is typically not comparable to the salary of a full-time job.

Effect on financial aid eligibility: Federal and State regulations require the university

to coordinate and review all educationally related awards a student is receiving in

determining their eligibility for need-based federal, state, and institutional aid.

This coordination must happen even if the need-based aid has already been disbursed

to the student. The combination of all awards

cannot exceed a student’s financial aid needs. If it does, need-based aid must be

adjusted, normally reducing the student's loan burden or work-study obligation.

Prize/Award - Non-Educational Direct Payments

The taxability of prizes is governed by IRS Section 74. A prize is a cash award or other tangible personal property bestowed to recognize outstanding achievement in teaching, research, academic performance, or other performance-related activities. They can be distinguished from scholarships because they are granted for future educational activities, and prizes are issued to honor past achievements or award-winning contestants in competitions. Prizes are generally taxable and are reported on Form 1099-NEC if they meet the reporting threshold.

It should be noted that a scholarship prize won in a contest is not a scholarship where there is no requirement that it be used for educational purposes. But, if the winner can only use the prize money to pay tuition, the prize is a scholarship.

Monies given to a student for reasons listed below constitute financial aid:

- Tuition and fees

- Books

- Supplies and equipment required for a course

- Room and board, and

- Research where the student is the primary beneficiary (research not considered wages)

Travel Reimbursement

Only travel where the student formally represents SJSU while presenting, serving, or participating can be considered a travel reimbursement–with no IRS reporting.

As part of travel, where the student did not formally represent SJSU, then:

- If the student is an SJSU student in a degree-seeking program and eligible for financial aid, consider it a financial aid payment.

- If the student is an SJSU student but not in a degree-seeking program (therefore not eligible for financial aid), then the payment is processed through Payment Services (subject to IRS 1099 or 1042S)

- If the recipient is not an SJSU student, process through Payment Services (subject to IRS 1099 or 1042S)

Wages or Compensation for Services Rendered (Employment)

A payment is considered compensation for services if:

- the amount represents payment for past or present employment services,

- the student is paid a fair market value wage for the service provided, and an employee/employer

relationship exists, which is defined as:

- The work to be performed is part of the regular business activity of the university, including planned time schedules and breaks.

- The student is subject to discipline or discharge under University personnel policies and may be discharged at the University's discretion.

- The individual can quit or be terminated anytime, and payments will only be made for services already rendered.

Examples of student employment include work as a student assistant, work-study student, lab assistant, tutor, exam proctor, or research assistant.

Research or service payments: refer to the Decision Tree below to determine if the student payment is considered financial aid (1098-T) or wages (IRS W-2).

Effect on financial aid eligibility: Payment for employment does not directly affect a student’s eligibility for need-based federal, state, or institutional aid. Students receive W-2 forms, and earnings are accounted for in their adjusted gross income, if applicable when they apply for financial aid for the next year.

Note of Stipends

The term stipend is used broadly to describe a variety of student payments. Stipends may be paid for class participation and/or general educational support. Stipends may have accompanying terms and conditions, and the stipend may be gradually adjusted or completely suspended if those terms and conditions are not met. Terms and conditions may include enrollment in a particular degree program, participation in program activities, or maintaining a minimum grade point average. Any such terms and conditions will be stipulated in the award agreement issued by the sponsor.

If the recipient is a candidate for a degree, he/she can generally exclude from income that part of the stipend used for qualified educational expenses (tuition, enrollment fees, books and supplies, and other expenses required for enrollment or attendance). The recipient cannot exclude from income any part of the stipend not required by the institution and used for other purposes, such as housing, meals, living allowances, travel, and non-required supplies.

Sponsoring agencies and faculty commonly use stipend or participant support to describe student financial assistance. Federal and State tax regulations do not define stipend but use scholarship and fellowship.

Stipend vs. Wages: The term stipend is sometimes misused to describe minor service payments. However, wages constitute

an employer-employee relationship and are considered taxable. A stipend can only be

used for training and educational purposes related to a sponsored program. It

cannot be used to pay for an individual's work or services performed or as incentive

pay.

In some instances, the stipend recipient may be required to attend certain classes or perform certain activities as a condition of receiving the stipend. These can still be considered stipends and not services (wages) as long as the (educational) benefit of the activities is bestowed upon the recipient and the paying institution does not benefit from the activities.

No quid pro quo: Stipends cannot be paid for services rendered. Any amount paid for a service rendered is considered a wage under IRS regulations and must be processed and taxed as a salary or wage. This includes payment for teaching, research, or other services rendered as a condition for receiving the scholarship or tuition reduction. These payments are considered compensation even if the services are a condition of receiving the funds or are required of all candidates for the degree.

The entire Payments to Students Guidelines and Procedures [pdf] information above contains all relevant information necessary for departments to identify the proper classification of each payment to students.